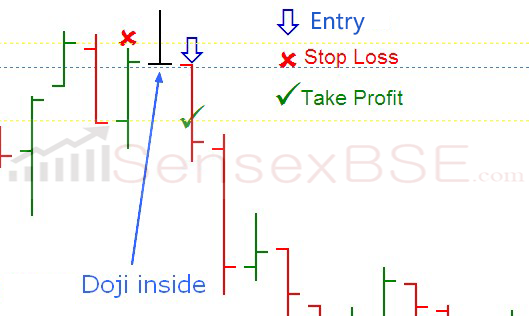

In this article I want to show a simple scalping technique with a Doji inside bar , which occurs in particular conditions. By scalping I mean a very short term and fixed target operation. In fact, this technique does not necessarily show the beginning of a large trend, but also and above all short rebounds or price returns, useful for a small profit.

[membership_protected_content user=non-member]

Unlock all premium content by purchasing Monthly Subscription plan. You’ll also get Stock buy/sell levels with charts before market open. Checkout our old stocks levels recommendation. If you already have membership please login [/membership_protected_content]

[membership_protected_content]

I have already written about Doji bars in another article in a generic way. They – in the simplest and most practical sense – show a change (short or large) in the direction of the price. The technique in question, however, goes into the specific, indicating a formation of a Doji inside bar , i.e. contained in the price range (opening – closing) of a previous bar.

But what does this technique consist of and how does it work?

The technique is very simple and can also be used with candles, on any fairly liquid financial instrument and on any time frame, however, before testing it in real life, I recommend trying it with demo account . Obviously, a larger temporal space also presupposes a greater and more reliable movement.

The conditions for the possibility of entry with this technique to occur are the following:

– a Doji inside bar , i.e. contained in the opening and closing range of the previous bar;

– the previous bar must be wide enough to allow operation;

– the Doji bar must have a long shadow at least 5 times its body (i.e. the amplitude between opening and closing which in the example image is practically zero);

– the shadow of the Doji bar must be reversed upon entering;

– entry is not expected with a gap ;

– it is not possible to enter the economic news release times .

When to enter the trade? And where to put the take profit and the stop loss?

The entry takes place in the bar following the Doji, when it breaks in the opposite direction to the shadow. The initial objective can be identified with the body of the bar prior to the Doji, so in the figure it is close to the opening of the green bar before the Doji. If you want you can manage the operation by closing only half of the tradeat that level and run any subsequent profits, protecting with the stop on entry. The stop loss is inserted on the high of the bar before the Doji (or on the minimum in the case of an upward entry). It can also be set to the maximum of Doji, but in this case the risk is greater.

[/membership_protected_content]