“Birthday Candle Scalping: trading with the birthday candle”

- Birthday Candle Scalping

- Why birthday candle?

- When to enter with the birthday candle

- Here are some simpler cases of birthday candle entry:

- What time frames can you trade with the birthday candle?

- Where to put stop loss and take profit with this technique?

- On which instruments and at what times to trade?

[membership_protected_content user=non-member] Unlock all premium content by purchasing Monthly Subscription plan. You’ll also get Stock buy/sell levels with charts before market open. Checkout our old stocks levels recommendation. If you already have membership please login [/membership_protected_content]

[membership_protected_content]

No, it’s not my birthday, “ Birthday Candle ” is just the name I gave to a candle with which I scale the price action . Why did I give it this name and how does it work?

I could have called it in any way to explain its meaning and distinguish it better from the others, but the name ” birthday candle ” seemed more appropriate than a “death candle”! 🙂

I don’t know if other traders have given it a name, because I’ve never heard of it, but I have studied its functionality personally through a lot of experience in the field.

You can call it what you like, the important thing is to understand how and when it is formed and how and when to trade with the birthday candle .

Birthday Candle Scalping

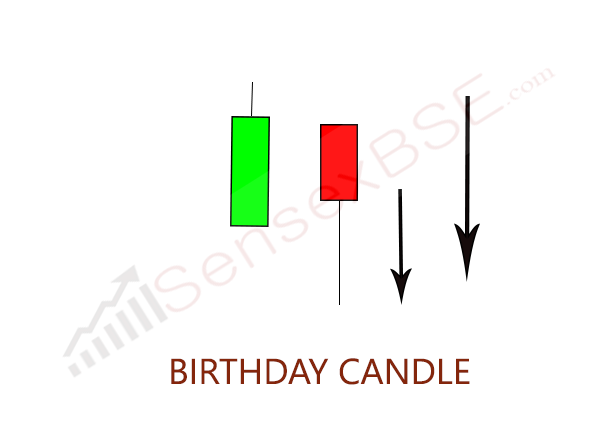

The birthday candle is a bearish “pattern” formed by 2 candles (or more candles together, but in this case we deal with the simpler version first to better understand), the first bullish and the second bearish.

The peculiarity of these candles is that, once formed on the chart, in the event that the price exceeds a certain level, the latter could fall again and in a short time.

Why birthday candle?

Because visibly the first candle of the pattern , that is the bullish one, really looks like a candle to put on the birthday cake, because it has a fairly accentuated bullish shadow and could give the idea of the flame of a candle.

Then the bearish candle is formed , usually with a lower high and a lower low than the previous one and with a bearish shadow this time. The shadow is the pedestal to be planted in the cake, which is also equivalent to the wish to make come true! The wider the shadow, the more the probability of success increases, or rather, that the birthday gift will meet your expectations.

When to enter with the birthday candle?

After having visualized the wish, you have to wait for the right moment to extinguish the candle, neither too soon nor too late, therefore we must first of all avoid the flame that is too high, because it could burn us and equally, we must be careful not to let the candle go out by itself. In the latter case, that is, if we are late, it is better not to enter and wait for a second signal or another opportunity.

What you need to do to understand when is the right time to blow out the candle is to see what the price does with the next candle. So never enter during training.

There are many cases, dealing with trading with price action , which is precisely what you have to study and learn with experience and many hours in front of the charts in real time (which is different from the charts already made).

Here are some simpler cases of birthday candle entry:

- the price falls below the minimum of the second birthday candle, that is the bearish one, then it goes down;

- the candle following the 2 is bearish, but does not exceed the minimum, you enter short when the minimum of the latter is exceeded or at the opening of the next candle;

- the candle following the 2 is bullish and exceeds the high of the previous one, so you enter a fall only after the price exceeds the low of a new bearish candle, but only if the highs have not been exceeded by too many points, because the price could having taken another direction;

- the candle following the 2 is bearish but with a high higher than candle 2, it goes down when the low of this candle, of the 2 or the close of candle 2 is exceeded.

What time frames can you trade with the birthday candle?

The trading with candle birthday is pure scalping , at least for me, because they take advantage of faster movements caused by those who took large sums of capital. However, it is also possible to find excellent ideas on wider time frames, intraday but also multiday. I take them into consideration, but I never enter based on them alone, because the stop loss would be too expensive.

Where to put stop loss and take profit with this technique?

In my trading plan I have a maximum stop loss limit , so it is automatically set together with the profit targets. Then of course I change all the targets based on the price levels, but the stop loss never increases, at most I reduce it if the technical limit is lower.

Once you understand how much your maximum loss can be for your trade, you can eventually reduce the stop on the following technical levels, based on your risk appetite and type of trading:

- on the maximum of the birthday candle 2;

- on the maximum of the birthday candle 1;

- on the maximum of the third candle or more for multiple formations.

The first profit must be short , based on your stop loss, the reference timing and the shadow of candle 2. The more the shadow of candle 2 is accentuated, the more the price could move in your direction, so you can have a wider TP and vice versa.

But I remind you that we always talk about greater or lesser probabilities and never about certainty.

I usually do this for take profit :

- first profit double or equal to the stop loss, it depends on the situation as I explained to you and with 2/3 of the position (see also how to close a part of a position );

- second profit on an important price level, such as the closing of a previous day or other;

- third profit on an important next level, in this way you let the profits run .

On which instruments and at what times to trade?

The birthday candle is caused by the movements of large capital, strong hands or market movers or whatever you want to call them, so it has a greater response during the busiest phases of the day, those with more volumes.

The birthday candle can occur both in a bearish trend and on a relative maximum and on most of the financial instruments that I have explored. Obviously the tools must be studied and deepened, because the price action is different for each of them, even if the formation is similar.

[/membership_protected_content]