Our 12th company in the Series of Best Stocks Below Rs. 100 is Welspun India Ltd.

This company is good for investing purpose or not ?

Let’s start with the Company profile

Company Profile :

Welspun India Limited is engaged in the textile business. It manufactures a range of home textile products, primarily terry towels, bed linen products and rugs.

Now Let’s check the important fundamental figures of this company. This is a small cap company with Market Cap ₹6,476cr. We can check more fundamental details below in depth:

Company Fundamental Detail :

PE Ratio: 10.77

Sector PE Ratio: 144.35

PE Ratio of this company is low than Sector’s PE. So it’s a Good PE than the peers of this company.

PB Ratio : 1.73

Sector PB Ratio: 5.75

PB Ratio of this company is low than Sector’s PB ratio. So it’s Good PB than the peers of this company.

Dividend Yield : 0.23%

Sector Dividend Yield : 0.63%

Dividend of this company is low than Sector’s dividend. So it’s Below Average PB than the peers of this company.

ROE: 15.77%

ROCE: 20.15%

ROE (Return on equity) and ROCE (Return on capital equity) is Average.

According to above data, this company is looking fundamentally average. Now We’ll check the company Financially data:

Company Financial Detail

| Year | Revenue(cr.) | Profit(cr.) |

| 2022 | 9,377.44 | 601.17 |

| 2021 | 7,408.02 | 539.67 |

| 2020 | 6,879.60 | 507.37 |

| 2019 | 6,608.44 | 209.84 |

We should check now liabilities of company also in the below table

Total Current & Non Current Liabilities

| 2021 | 2020 | 2019 | 2018 |

| 4,822.52 | 5,137.21 | 4,832.14 | 4,534.62 |

Liabilities of a company refers to the debt of that company. We should also aware the debt of company. In 2021 , Company have 4,822.52 Cr. debt.

Let’s check the Free Cash flow of the company

Free Cash flow

| 2021 | 2020 | 2019 | 2018 |

| 503.74 | 259.32 | 67.20 | 207.20 |

Debt Level: Welspun India net debt to equity ratio (54.7%) is considered high.

Reducing Debt: Welspun India debt to equity ratio has reduced from 136.1% to 78.2% over the past 5 years.

Debt Coverage: Welspun India debt is not well covered by operating cash flow (18.4%).

Interest Coverage: Welspun India interest payments on its debt are well covered by EBIT (7.2x coverage).

Share Holding Pattern

| Promotor Holding | Foreign Institution | Mutual Fund | Other Domestic Institutions | Retail & Others | |

| Mar 2022 | 70.36% | 8.52% | 2.32% | 2.93% | 15.88% |

| Dec 2021 | 70.36% | 9.07% | 2.55% | 2.35% | 15.68% |

| Sep 2021 | 70.36% | 7.77% | 3.75% | 2.07% | 16.05% |

| Jun 2021 | 70.36% | 6.88% | 5.26% | 2.07% | 15.82% |

Above table showing there is no big change in Promotors holding which is 70.36% in June 2022. FIIs invested in June 2022 with 8.52% and retail investor is 15.88%.

Investment Checklist for Welspun India Ltd.

- The company is currently profitable

- Debt is not well covered by operating cash flow

- Volatile share price over the past 3 months

- Earnings are forecast to grow by an average of 23.1% per year for the next 3 years

- Dividend is too low to be a concern

- The company’s earnings are high quality

- Profit margins decreased but not substantially

- They have sufficient analyst coverage

- Shareholders have not been meaningfully diluted in the past year or recently listed

- Revenue is meaningful (₹93B)

- Market cap is meaningful (₹65B)

- Welspun India Ltd does not have negative shareholders equity.

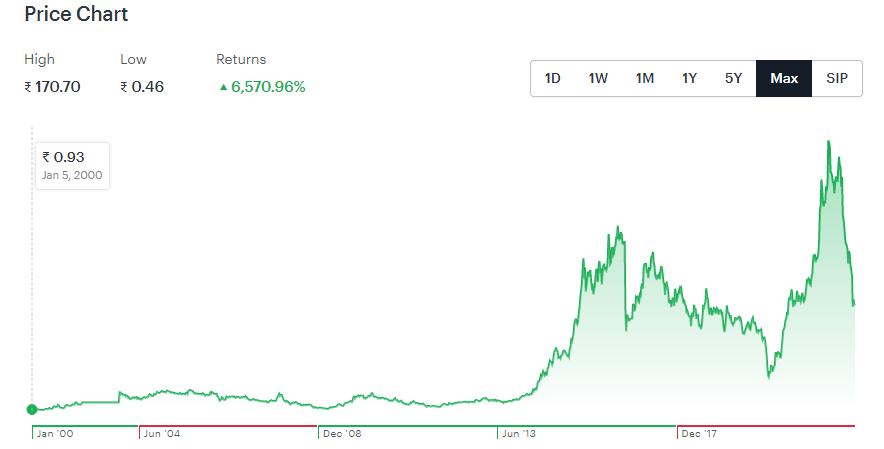

According to its historical performance we can predict stock target.

[membership_protected_content user=non-member]

Entry Buying Zone : Premium members can see only

Target: Premium members can see only

Time Horizon:Premium members can see only

Risk Profile: Premium members can see only

[/membership_protected_content]

[membership_protected_content]

Entry Buying Zone : 60 to 62

Target: 90 (50% Upside)

Time Horizon: 6-8 Months

Risk Profile: High Risk (Stock is 2.46x as volatile as Nifty)

[/membership_protected_content]

Hope you liked Our 12th company in the Series of Best Stocks Below Rs. 100. We tried to cover many important things about this company, if you think anything left to cover, you can comment us and we’ll try to cover those things also.

Disclaimer: This is an Educational Initiative and is NOT registered under any SEBI regulations. All the information that we provide is just for Educational purposes and you should consult your financial adviser before taking any investment decision. Also we do NOT provide any form of Stock Tips or Advise on stocks or portfolios. My All Trades Only Education Purpose. All trades will be at your risk. You have the responsibility of any trade or any benefit or loss