[membership_protected_content user=non-member]

Unlock all premium content by purchasing Monthly Subscription plan. You’ll also get Stock buy/sell levels with charts before market open. Checkout our old stocks levels recommendation. If you already have membership please login

[/membership_protected_content]

[membership_protected_content]

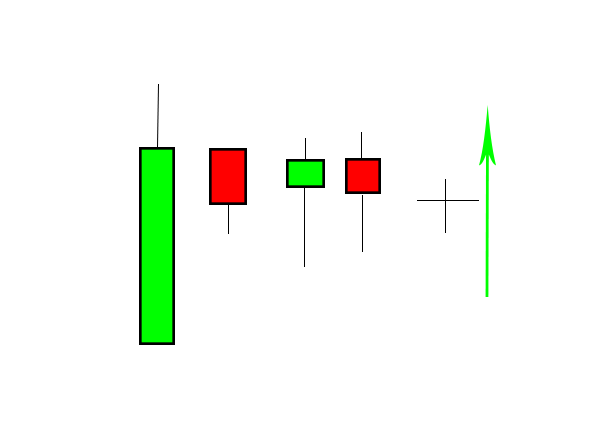

We are in the presence of a broad bullish outside bar with upper shadow that forms in an uptrend or is a breakout movement after a congestion, within which – and usually always below the close – are a series of bars inside, alternate. The price therefore moves sideways for a while.

Before a possible new directional movement, the price range narrows further, sometimes forming a small bar with the same closing and opening or slightly bullish, in the best cases contained in the previous bar.

Operational idea

- You enter long when the price breaks the low of the last bearish bar and then rises above the close or the high of the last bar or the series of inside bars in congestion;

- sometimes the price, after a new break, returns to near the last bar and therefore a new upward entry can be attempted;

- after the break up or a new trend, in the event that there are the presuppositions of a reversal and a large profit margin, it is possible to try a downward entry until reaching the maximum of the outside bar;

- in the first 2 cases, the stop loss goes to the minimum of the last smallest bar or to the closing of the same or to the minimum of the bar in formation;

- take profit as always;

- in the case of reversal, the stop loss must be calculated based on the entry and the take profit , as I have already said, on the maximum of the outside bar.

[/membership_protected_content]