How much do you determine the value of shares? This question concerns many investors.

There are several ways to value a share. Some investors focus on the net asset value, while others attach a lot of value to the price development. In this article I show how I fundamentally value a company and which characteristics I consider important.

My stock valuation has several steps, which I will discuss separately:

- How sustainable is the business product?

- What are the advantages of the company over the competition?

- What kind of return does the company get from the invested capital?

- How does the company invest its available capital?

- How much do I pay for the share in relation to the assets?

- The value of growth

- What does the market think and do I have a different opinion?

- Conclusion: what is the share worth?

[membership_protected_content user=non-member]

Unlock all premium content by purchasing Monthly Subscription plan. You’ll also get Stock buy/sell levels with charts before market open. Checkout our old stocks levels recommendation. If you already have membership please login [/membership_protected_content][membership_protected_content]

How do I calculate the value of shares?

1. How sustainable is the company product?

An important first question to ask is how sustainable the company product is. When it is uncertain whether the demand for the product is permanent, this creates various risks. It raises questions about the sustainability of the current results. Since fundamental analysis primarily reasons from the current situation, it is important to know whether the current situation is somewhat stable. A stable situation increases the chances that the current situation will continue. This can allow you to value the current profit higher because the profit is more likely to stay. When there is a good chance that a product will become obsolete, this creates different types of risks.

The most important is that the value of the current business activities lose their value. For example, if the company’s activities are no longer relevant in 10 years’ time, this will greatly reduce the value of the company.

Sustainability can be divided into the probability of the product becoming obsolete and the cycle of sales. Products that are very cyclical are less stable. It is dangerous to value cyclical companies by current earnings. Cyclical companies should be valued by the profit generated by the economic cycles. The best time to buy stocks in cyclical companies is when current profitability is failing. In that case, the shares can benefit from a possible recovery.

Economic cycles

Ideally, you have business products that are stable and not affected by the economic cycles too much. The results of these types of businesses are the easiest to predict and have the long-term advantage of being able to use the company’s facilities efficiently. Cyclical companies are often forced to slow down factories in times of economic downturn. This inefficiency means that returns on capital for cyclical companies are often lower throughout the cycle.

A change in the situation can also be interesting, but in that case you want to respond to a certain change. In such a situation you will therefore have to analyze what the future situation will look like and what the results will be in that case. In this case too, it is important that the future situation persists for a considerable time. Companies that can only temporarily generate a high profit are usually not valued at a high multiple of this profit.

2. What are the advantages of the company over the competition?

An important next question in determining the value of shares is about the company’s position in relation to the competition. The product is therefore attractive and popular in the future. This is of little value to shareholders if the profit is made by a competitor. It is therefore important to consider what advantages the company has and where the competition is doing better. It is also important to see how sustainable they are for the benefits. Companies can have several benefits. The most famous and often clearly visible is scale. Large companies have more budget and can therefore spend more on research and distribute a lot of costs over several products. Yet the world is not only made up of large companies. Large companies are often bureaucratic and less flexible. Companies are often reluctant to change if it is at the expense of profit in the short term. Moreover, economies of scale can often be offset by higher overhead costs.

Strategic choices

Lower costs are a clearer advantage in that respect, but the question is where these lower costs come from. Lidl and Ryanair, for example, have low costs, but in many cases this goes together with less service. High quality service can also be a differentiator. Often it pays off for a company to focus on something. Both low costs and high service quality are often difficult to combine. Which choice the company makes and which is the most lucrative in that market depends, among other things, on the market itself and the choices made by the competition.

Causes of competitive advantage can often be found in matters that are not immediately obvious. Examples are a more efficient distribution network, better locations or certain patents. Sometimes the advantage is even a certain brand, with which customers have a positive association.

3. What kind of return does the company get from the invested capital?

To determine the value of stocks, we now want to know how lucrative the business activities are. For this I always look first at the return on invested capital. This indicates how much profit a business can derive from the amount of capital put into the business. By starting from capital, loan capital is also included. Companies that need a lot of debt to realize a good return on equity usually have a higher risk. In some cases, however, a large portion of the capital may be contributed by customers. Take Amazon, for example, which pays its suppliers later than when it receives the money from its customers. The company can invest this difference free of charge without paying interest on it.

Margins or sales

There are several reasons why companies have a high return on capital. The most obvious is higher margins. When margins are high, a company earns a lot from its sold products. However, this is not the only way that returns can be high. Supermarkets, for example, do a lot of turnover with low margins. Due to the high sales relative to the invested capital, the returns can still be attractive. For supermarkets it is therefore important to sell stuff quickly, because slow sales lead to unnecessary stocks and a lower profitability.

Something to always consider when determining the value of stocks is how much a company must invest to keep itself going. In some cases, depreciation and amortization are not a good measure of the necessary investments. A sector such as the car industry often invests more than the depreciation. This results in better cars, but in many cases does not strengthen the competitive situation. This is because the competition is also constantly coming up with new, better cars.

Companies with high returns on capital are often safer than those with lower returns. A small decrease can quickly lead to a loss with a low return. Companies with a high return are more resistant to this.

4. How does the company invest its available capital?

A high profit on invested capital is nice, but possibly even more important for the value of shares is the question whether the company can continue to invest against this return. Some companies have terribly good returns on existing capital, but cannot invest more capital at the same returns. A classic example of this is Coca-Cola. The company makes a profit and has high margins, but cannot reinvest those profits. The company chooses to distribute a large part of the profit in the form of dividends. In addition, Coca-Cola is also buying back its own shares. Warren Buffett’s stake in Coca-Cola has risen in this way since 1988 from 6.2% to 9.36% of the company with no additional investment. In fact, Coca-Cola has been paying a rising dividend to its shareholders for 55 years.

Reinvest, takeovers & return money

There are basically three ways in which a company can use its available capital. It can reinvest in the business activities. This is the preferred activity when the company is making a high return on these investments. The company can make acquisitions, which can sometimes be useful for strategic reasons, but historically the return on acquisitions has been disappointing. Finally, the company can distribute the profits in the form of dividends or share buybacks. In this way, the money flows back to the investors who can then invest or consume it themselves. Many investors place a lot of focus on the dividend, but the most lucrative is reinvestment. When a company can grow profits quickly through reinvestment, the company becomes worth more, which determines the value of the stock. Especially when it is invested at a high return. Some companies have a return on invested capital of over 20%. Such a return is difficult to achieve in other ways without taking much greater risks.

5. How much do I pay for the assets?

Now that we have an idea of how much return the capital will generate in the future, let’s see how much we have to pay for it. The assets on the balance sheet have a certain value. In some cases the company can be liquidated, but in others it is difficult. When the expected return on invested capital is high, you can pay more for this. Particularly if the company can also invest in the future at high returns, this increases the value of the shares.

Starting return vs. growth

An important measure is the initial yield. How much cash do you get in the beginning and how will it develop in the future. Many investors focus on growth or initial return. However, the combination is important. Companies with a very high start-up yield have no growth, but even shrinkage. This does not mean that the investment is bad. A high enough starting efficiency can compensate for shrinkage. Ideally, however, you will see a reasonable initial return, which the company can continue to reinvest in growth. It is difficult to grow organically with a very small starting return. In these cases, little capital is available and the company has to raise new capital. It is uncertain at what price the market will supply new capital and, moreover, the capital markets are not always open or available at reasonable rates.

6. The value of growth

We also look at growth to determine the value of shares. Growth is always seen as a good thing. Growing companies are always seen as attractive. However, this need not be the case. How attractive investing in growth is depends on the return. Companies that can only invest for low returns should focus on returning money to the shareholder. The shareholder can then invest it for a higher return. However, management often benefits from more investment. A larger company creates more prestige and in most cases a higher salary. A growing company also has more career opportunities for employees. Yet it is often better for returns if companies with low returns would consciously shrink. Some companies do have the opportunity to make investments at high returns. In those cases, the focus must therefore be fully on exploiting these opportunities. This has become more accepted and many technology companies, for example, have never paid dividends.

7. Am I thinking differently from the stock market?

To make a lot of money in the stock market you have to change your mind and be right. There is no shortage of different opinions, but the market is usually quite good to show the average of these opinions. When you do something other than the market and are not proven right, you quickly face significant losses. For these reasons, it is important to know what the market is thinking. This allows you to see where you have a different opinion and to substantiate this opinion. It also ensures that you do not accidentally take risks without realizing it.

8. Conclusion: what is a share worth?

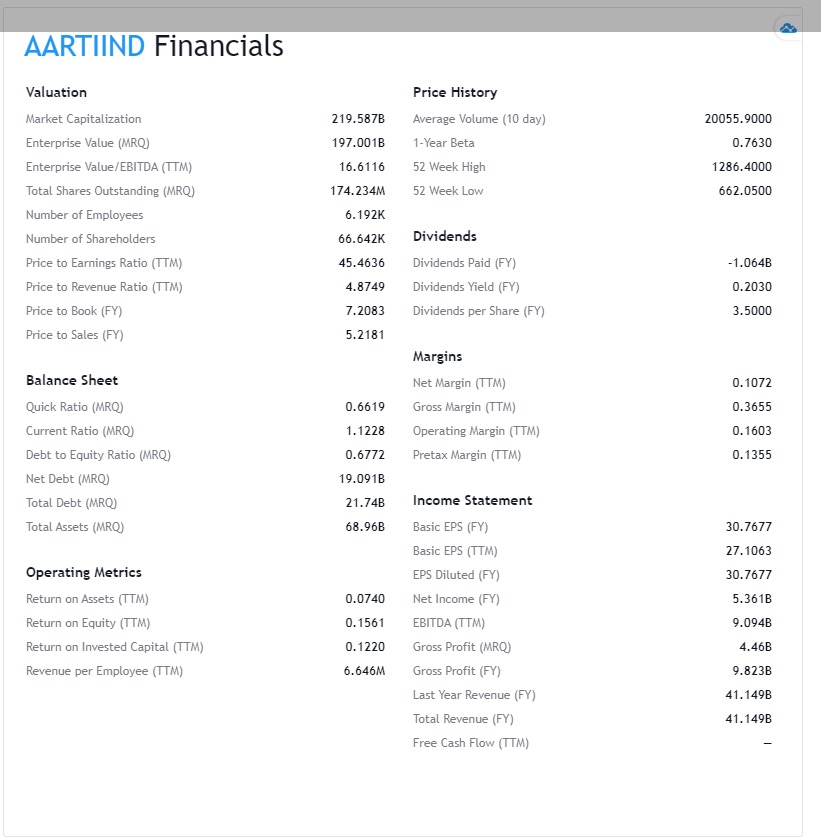

By looking at both the future and the present, an outline can be made of the value of a company. This can then be offset against the outstanding debt and the number of shares to arrive at a value per share. Valuation and initial yield play an important role in this, but return on capital and growth prospects are also important. Financial ratios can aid in calculations and comparisons with other competitors.

Financial ratios & key figures

You can find a lot of information about companies on our website. This helps investors value a company and determine the value of its shares. In addition to the financial key figures, you can also find the expectations of analysts and a description of the business activities.

[/membership_protected_content]