18 Inside Bars that can change your trading

-

- Bullish Inside bars with upper shadow

- 1 # Inside bar bullish on relative high

- The price moves like this:

- What is the operational idea?

- 2 # Inside bar bullish on relative low

- Here’s how the price moves in that case:

- The operational idea is:

- 3 # Inside bar bullish on relative low

- Operational idea:

- 4 # Inside bar bullish after relative high

- In our case, the price moves like this:

- The operational idea of trading is:

- 5 # Inside bullish bar in trend or after breakout

- The fundamental differences are these:

- What is the operational idea in that case?

- Bullish Inside bars with lower shadow

- 6 # Inside Bar bullish on relative high

- Here’s how the price moves:

- Operational idea:

- 7 # Inside Bar bullish on relative low

- How does the price move?

- Operational idea:

- 8 # Inside Bar bullish trending as a continuation signal

- How the price moves and operational ideas

- 9 # Inside Bar bullish in bearish trend

- How does the price move?

- Operational idea:

- Inside bearish and outside bullish bars

- 10 # Inside Bar bearish on relative low

- How does the price move?

- Operational idea:

- 11 # Inside Bar bearish on relative high

- Here’s how the price moves:

- Operational idea:

- 12 # Inside Bar bearish on relative low or in bullish trend

- How does the price move?

- The operational idea:

- 13 # Inside bar bearish with upper shadow on high

- 14 # Inside bullish bar with upper shadow in bullish trend

- The operational idea:

- Inside bars bearish after negative outside and series of insides

- 15 # Inside and Outside Bar bearish to low

- How does the price move?

- Operational idea

- 16 # Inside and Outside Bar bearish on high or in bearish trend

- What does it all mean?

- How does the price move?

- Operational idea

- 17 # Series of inside bars after broad bullish outside

- Operational idea

- 18 # Series of inside bars after broad bearish outside

- Operational idea

- Trading with inside bars

[/membership_protected_content]

[membership_protected_content]

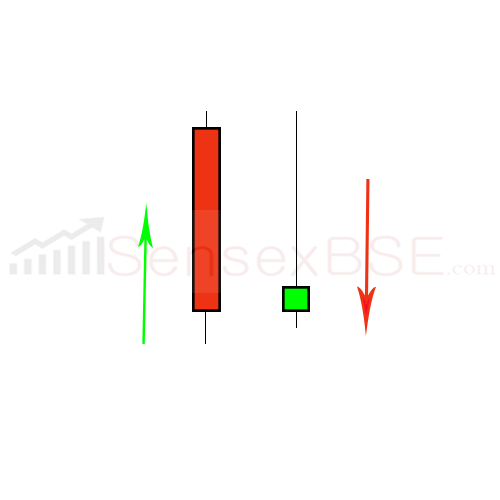

What are inside bars in trading ? You probably already know its meaning, but in a very general way I can tell you that an inside bar is a price bar contained in the previous one, which I will call outside for simplicity.

In a more technical way, an inside bar has a high lower than the high of the previous bar and a higher low than the low of the previous bar.

This text, however, does not deal with trivia or in any case the basics for trading , if you want to deepen the notions for beginners, I invite you to study the basics of the graphic analysis of the price that you can find for free even by searching or on technical analysis manuals or candlesticks .

These manuals will teach you how to locate the inside bars and how to enter, that is, as soon as one of the two sides of the inside is broken.

But is trading really that easy with inside bars?

Here I want to show you some particular inside bars that can really change the way you see a trading chart without technical indicators and therefore improve your practical approach to this complex business.

I will therefore try to introduce other important elements for trading with price action and not simple graphic patterns. This means that the images – somewhat spartan that you will see below – are the result of studies on price action and are just some of the most important cases concerning trading – or to be precise, my trading – with some types of inside bars.

Sometimes these bars – or Japanese candlesticks, as I have drawn them in the figures – in reality can be represented by several elements and in any case they can vary according to the traded instrument and the time frame.

In most cases, however, they are recognizable, especially by diligently studying one underlying at a time. I have found excellent feedback on both and indices that I trade in the hours of highest volatility.

Since it is a blog , I decided to take a cue mainly from the euro dollar exchange rate on intraday time frames and above all low, given that to date my most frequent activity is precisely scalping, although sometimes they are also referenced on wider temporal spaces. Being movements made by strong hands, they – I repeat – find the best reference in the hours of highest market volatility.

The last thing I want to tell you before starting with the explanation on these particular inside bars is not to trade on without having found a confirmation with the reality of what I am showing you.

A guide to inside bars – certainly incomplete, since there are really an infinite number of them with different characteristics – but that you probably won’t find on other websites, especially for free.

Mine is not an incentive to trade in this way and immediately, but it is intended as a starting point to reflect on the reality of price action.

Explaining it in a static way is not at all easy, as I already told you in the post on the decision bar of strong hands , because the price action is never static. I will also try to show you some other pieces of my daily trading and that is what I see when I look at a chart without indicators and an inside bar appears in front of me.

1 # Inside bar bullish on relative high

In Figure 1 we are in the presence of a relative maximum. What does it mean?

The price has risen for a short or longer period of time (uptrend) and now we have reached a maximum of at least 20 bars. This maximum can sometimes also occur in the bar before the red one or a couple before.

To simplify the explanation, we find ourselves in the case where the relative maximum is the maximum of the bearish bar, that is, the one that contains the next bullish inside bar.

The price moves like this:

The price moves like this:

- upward movement (previous trend or upward breakout);

- relative maximum of 20 bars (high red bar outside);

- stop of the bullish movement with a fast recovery downwards (red bar);

- indecision on the immediate downside (small lower shadow of the red bar);

- indecision that continues on the next bar, the so-called inside, with the price that opens on the close of the previous outside bar, drops very slightly and rises nervously just below the top of the outside bar, and then falls again and closes a little above its own opening. Sometimes it is a real doji, with identical opening and closing;

- new pretense of the price that first rises, sometimes to the maximum of the inside bar and other times a little below, and then quickly falls below the minimum of the inside bar.

What is the operational idea?

- you go short as soon as the price exceeds the low of the inside bar, but only if it has had the upward movement before falling. Remember that it is always better to miss a good opportunity and not enter 100 not totally defined to find one that is successful among them;

- you can anticipate the trade if you know the movement of a certain underlying well, as happens and that is, within the moment in which – after the rise following the inside bar – the price hints at the descent or exceeds the closing (here precisely the trading with the real action of the price that does not need to wait for “pattern”);

- the stop loss must be put on the basis of risk appetite, in any case, with a decreasing risk, you can opt for the maximum of the red outside bar, the maximum of the inside bar or the maximum of the candle in formation;

- the take profit must be set at least double or triple the stop value, but to let the profits run , I opt for a small immediate profit with most of my position.

[/membership_protected_content]