Our 16th company in the Series of Best Stocks to Buy in India for Long term 2022 is Tech Mahindra Ltd.

This company is good for investing purpose or not ?

Let’s start with the Company profile

Company Profile :

Tech Mahindra Limited is engaged in the business of computer programming, consultancy and related services. It’s segments include Information Technology (IT) Services and Business Processing Outsourcing (BPO).

Now Let’s check the important fundamental figures of this company. This is a large cap company with Market Cap ₹1,61,197cr. We can check more fundamental details below in depth:

Company Fundamental Detail :

PE Ratio: 36.40

Sector PE Ratio: 41.52

PE Ratio of this company is low than Sector’s PE. So it’s a Average PE than the peers of this company.

PB Ratio : 6.39

Sector PB Ratio : 9.99

PB Ratio of this company is low than Sector’s PB ratio. So it’s Average PB than the peers of this company.

Dividend Yield : 2.70%

Sector Dividend Yield : 1.04%

Dividend of this company is high than Sector’s dividend. So it’s Good PB than the peers of this company.

ROE: 16.94%

ROCE: 20.39%

ROE (Return on equity) and ROCE (Return on capital equity) is Average.

According to above data, this company is looking fundamentally average. Now We’ll check the company Financially data:

Company Financial Detail

| Year | Revenue(cr.) | Profit(cr.) |

| 2021 | 38,643.40 | 4,428.00 |

| 2020 | 38,060.10 | 4,033.00 |

| 2019 | 35,276.30 | 4,297.60 |

| 2018 | 32,189.50 | 3,799.80 |

We should check now liabilities of company also in the below table

Total Current & Non Current Liabilities

| 2021 | 2020 | 2019 | 2018 |

| 14,357.40 | 15,111.50 | 12,683.70 | 11,079.50 |

Liabilities of a company refers to the debt of that company. We should also aware the debt of company. In 2021 , Company have 14,357.40 Cr. debt.

Let’s check the Free Cash flow of the company

Free Cash flow

| 2021 | 2020 | 2019 | 2018 |

| 7,427.80 | 3,513.50 | 3,627.40 | 2,536.90 |

Debt Level: TECHM has more cash than its total debt.

Reducing Debt: TECHM’s debt to equity ratio has reduced from 6.4% to 6% over the past 5 years.

Debt Coverage: TECHM’s debt is well covered by operating cash flow (427.4%).

Interest Coverage: TECHM earns more interest than it pays, so coverage of interest payments is not a concern.

Share Holding Pattern

| Promotor Holding | Foreign Institution | Mutual Fund | Other Domestic Institutions | Retail & Others | |

| Jun 2021 | 35.67% | 35.35% | 9.60% | 7.62% | 11.75% |

| Mar 2021 | 35.70% | 35.35% | 9.81% | 7.10% | 11.84% |

| Dec 2020 | 35.73% | 35.35% | 9.48% | 6.83% | 11.80% |

| Sep 2020 | 35.76% | 35.33% | 8.72% | 5.51% | 11.79% |

Above table showing there is no big change in Promotors holding which is 35.67% in June 2021. FIIs invested in June 2021 with 35.35% and retail investor is 11.75%.

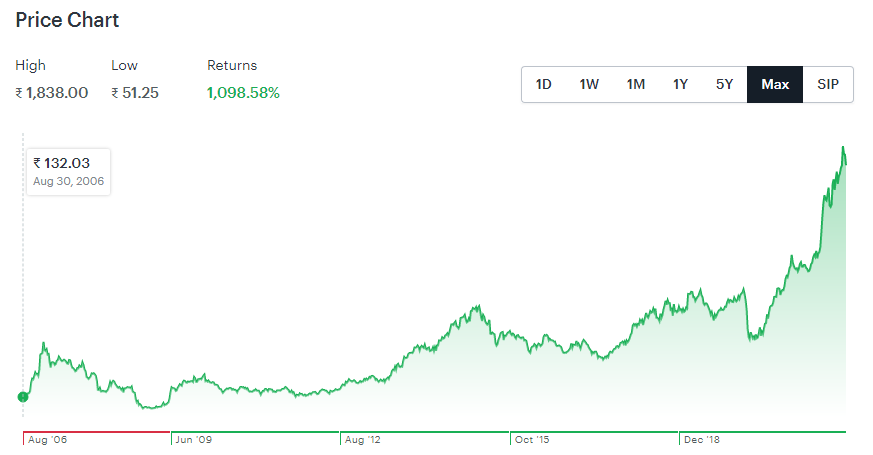

Now We’ll check the return of the company, This company given 66.37% returns in last 1 year from 2021 to 18 Jan 2022.

Investment Checklist for Tech Mahindra Ltd.

- The company is currently profitable

- Earnings are forecast to grow by an average of 12.7% per year for the next 3 years

- Debt level is low and not considered a risk

- Share price has been stable over the past 3 months

- The company’s earnings are high quality

- Profit margins improved or TECHM became profitable

- They have sufficient analyst coverage

- Shareholders have not been meaningfully diluted in the past year or recently listed

- Revenue is meaningful (₹405B)

- Market cap is meaningful (₹1,455B)

- TECHM does not have negative shareholders equity.

According to its historical performance we can predict stock target.

[membership_protected_content user=non-member]

Entry Buying Zone : Premium members can see only

Target: Premium members can see only

Time Horizon:Premium members can see only

Risk Profile: Premium members can see only

[/membership_protected_content]

[membership_protected_content]

Entry Buying Zone : 1450 to 1500

Target: 1900 (30% Upside)

Time Horizon: 1 Year

Risk Profile: Low Risk (Stock is 1.88x as volatile as Nifty)

[/membership_protected_content]

Hope you liked Our 16th company in the Series of Best stocks to buy in India for Long term 2022. We tried to cover many important things about this company, if you think anything left to cover, you can comment us and we’ll try to cover those things also.

Disclaimer: This is an Educational Initiative and is NOT registered under any SEBI regulations. All the information that we provide is just for Educational purposes and you should consult your financial adviser before taking any investment decision. Also we do NOT provide any form of Stock Tips or Advise on stocks or portfolios. My All Trades Only Education Purpose. All trades will be at your risk. You have the responsibility of any trade or any benefit or loss